Whenever people ask me how I make my plans, on my buying and selling points, they would always be surprised by how simple it seems. Usually there are just one or two trigger points that I watch out for.

You can see it in the charts I post. Minimal lines. Just one or two boxes at most. Sometimes none at all. Seeing too many lines just gives the impression of clutter and gives me a mental image of limiting a trade. Not giving it room to make it's move.

Yes, my plans are simple. But that does not necessarily mean that it is easy to implement. There is a big difference in the two.

Take for example my recent TBGI trade.

This entered into my personal scanner when it was making a tight range as shown in Figure 1.

This entered into my personal scanner when it was making a tight range as shown in Figure 1.

Figure 1

My plan was just to buy when that yellow box breaks. So on Aug 2, I bought at around .58-.59 and had to cut when it didn't follow through at the end of the day.

So I adjusted my plan as shown in Figure 2. This time I moved the buying area to .60 since that was the high of Aug 2.

Figure 2

So on Aug 3, the stock made a nice strong move again. I followed my plan and bought my shares at the .6 breakout point. All in one big tranche if I remember correctly. There was sufficient volume per fluc to accommodate a good enough size.

Figure 3

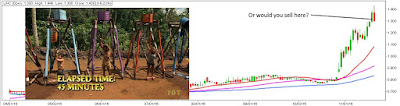

When it closed strong but below the recent high of .66 I made a mental note to sell at .66 on the next day. That is unless it made a strong move and made a breakout above it. Happily it made a gap up move and I just switched tactics to trail stops. Keeping in mind that there was a bigger resistance at .84, I wanted to see if it had enough strength to reach and break it intraday.

If it only made a breakout of .84, I would have added a new milestone of having a 7 digit day change in one port. But alas, it wasn't meant to be. I sold most of my shares at .78-.79. Not bad for a two day hold.

If it only made a breakout of .84, I would have added a new milestone of having a 7 digit day change in one port. But alas, it wasn't meant to be. I sold most of my shares at .78-.79. Not bad for a two day hold.