Let me try to give a short walk-through on how my neural networks implement a trend following trade. I will be using my latest trade, LIHC as an example.

The first thing to remember in doing a trend following trade is to watch your entry point or your average price (AEP). The ideal entry is to get in before or right at the start of the trend. How to do that? Read up on the boss's blog about ZS and AOTS. For LIHC, this was easy to spot since it also coincided with a multi year breakout.

Next comes the hard part. The holding time.

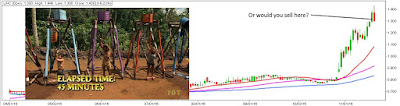

To get a better idea, watch this. These are the survivor endurance challenges. Where you have to outlast your competition for the chance of a bigger prize.

For this example, the contestants have to hold their arms up or else they will get splashed with paint. The host can tempt them with some small reward in exchange for stopping out. Or if they get tired, they can just put down their arm.

Or maybe if the chart or price action looks weak. There is nothing wrong with selling at those points. As long as you follow your plan then go ahead.

For me, I do not set target prices. I'd rather set trail stops. If the price goes down a certain point then that is when I sell. That point could be a previous resistance turned support, the previous close, a MA getting broken. It doesn't matter that I wasn't able to sell at the top. The important thing is I was able to ride the bigger move.

Another thing to consider when doing trend following trade is fighting the urge to move to the flavor of the day or the week. Like the bear in the GIF below, it's human nature to want to sell and then move to the faster moving stock. For this LIHC trade, there were several missed trades, CPG, BLOOM, FNI, STI, PPC, WEB to list a few.

But in reviewing my past trades, it was my inactivity that has given me bigger gains. Focusing on just a few trades a month has helped me to reach my quota or targets. My system is not really built for tsupita trades. That mindset or strategy has yielded a bad win/loss ratio over time. The losses negate the wins or just at breakeven. Plus the added mental stress of having to look for good trade setups everyday.

In reality, I am lazy. I'd rather make just a couple of trades a month then to trade multiple times a day/week. This fits more to my trader profile right now as well since I cannot be in front of the computer the whole day anymore.

screenshot date was close of 11/25/2016

Not bad for a one month hold don't you think? One trade for the whole of November. Do take note, actual selling was below 1.5 today 12/2/2016. Wasn't paying too much attention to the movement since I was busy doing other things.

Hello Sir Alpha Centauri, Thanks for sharing your TF experience.

ReplyDeleteI've been reading over and over again the blog of Sir Zeefreaks regarding ZS, AOTS and PUA but still I find difficulty in implementing it in my trading system.

I think may kulang pa na element somehow.

you're welcome

DeleteCan you help me in improving my system?

DeleteI dissected LIHC on how it made a monster rally. I want to share it with you and ask for you input if it is fine with you

Not sure what you want me to do. You can PM me thru facebook

DeleteI tried searching you thru facebook, but can't find you. Di ko rin makita ka sa mga friends ni si Sir Zee at Kap Kidlat. I'm not sure kung ikaw ba ito, Centaurus Chinook?

DeleteLook for Al P Cento Ri

DeletePM you already Sir

DeleteAOTS lang po ba gamit niyo dito?

ReplyDeleteAOTS + darvas + RSI

DeleteHi Sir Alpha Centauri, would like to ask how or when do you apply the darvas box? do you coincide it with fibonacci? Can I send you a pm on Facebook sir? I just want to know if I am doing it right. Hehehe, Thanks in advance po!

Deletei use it all the time.

Delete