Been getting a lot of PMs on how I spotted or traded this stock.

Here are my answers in a condensed form.

1. How do I you screen stocks?

I answered this during the class with the Eternus batch. I usually group stocks into certain categories. Then I'll select the best ones.

This is my selection process:

With that out of the way, I'll place that stock on my watchlist. Then I will stalk it until it shows me an optimal buy area. Usually on breakouts.

2. Where did you buy?

This is the simplest explanation I can give without revealing the tribe's secrets.

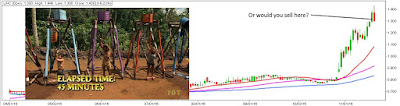

First buy was on the breakout here:

Second buy was somewhere here:

3. Why did you hold?

My trade objective for this was to trend follow. So I just kept moving my stops up.

My stop could either be the ff:

- previous resistance that was broken

- breakdown of a box

- a set price

4. All in?

Yes. This is my trader profile and I know and accept all of the risks that could happen. If you can't take it then please DO NOT go all in.

Lastly, the obligatory port snaps. This is the reason why this is a trophy trade for me. The gain that I got for this trade has been the biggest ever in monetary value in my whole trading career.

As boss zee said, it might be time to level up.

Take note though, this port snapshot was taken at the end of 09/25. I was not able to sell at the highs. But that is alright with me. It is the risk I am willing to take since I am doing trend following.

It's all about setting expectations. And with that I always remember this quote:

"As long as you accept the fact that you will never be able to sell at the highs, you will be fine."

Again my eternal gratitude to my mentors, Zee and Kap. Along with all the other mentors who push me to be the best trader I can be.