It is almost the end to this earth year. 2016 has been very fruitful. I think it's appropriate to give time for some quiet reflection.

It is almost the end to this earth year. 2016 has been very fruitful. I think it's appropriate to give time for some quiet reflection.It was Year 1 of being equipped with the ZF system. My immersion is still ongoing. And I do believe it is something that will not end soon. I still learn something new in every trade that I make. Ms Market is a hard mistress, she takes away as much as she gives. And it seems that I entered in a long term relationship with Ms Market, for better or worse.

Analyzing my trades, I still have a natural inclination to buy breakouts. It really is my bread and butter setup. Aside from breakouts though, there was a small collection of bounce trades here and there scattered once in a while. Then there are the TF trades. I still have to tighten my stops for those. There are still a lot of profit leaks in my trades and I plan to plug them eventually.

Going over my trades, I found out that my hit rate for the year is still pretty low, about 43%, so there is a still a lot of room for improvement.

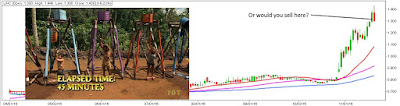

I was pleasantly surprised to find out that there were only a handful of stocks that gave me most of my gains.

Those are some of the trades where in I was able to gain multiple times in a single stock. I think I missed a couple of others but I think I was able to milk these stocks for all they're worth.

So after looking back on the past year, it's now time for some resolutions or goals for the new year.

One resolution for the new year is to really ramp up my documentation skills. There were a lot of trades that weren't documented properly, real and paper trades. So much potential learning lost. I hope that Excalibur, a tribe project, can help solve that particular weakness of mine.

Another resolution is to trade less. Focusing on those perfect setups. I have already started on this and have observed that this trait has been lessened this last quarter of 2016 but in the first two quarters, I had to return some gains/profit due to overtrading.

One more goal is to get some more badges. Seeing one of these bad boys in the palm of my hand has really stoked the competitive flames in me.

And lastly, will definitely step up my RAK game and have already discussed this with the Mrs Robot. We are now setting goals for this and identifying the potential beneficiaries for each quarter of 2017. That should be something to watch out for.

Ok, that's enough reflection for this robot. Here is some ear candy for you guys. Happy holidays and let's get ready for 2017!